net investment income tax 2021 form

Since 2013 certain higher-income individuals have been. Greetings I have a client that was a partner in a partnership that was bought out towards the.

Investment Expenses What S Tax Deductible Charles Schwab

Your IRS Form 1040 can help you calculate your net investment income tax.

. For example if a couple filing a joint return has a MAGI of 300000 and Net Investment Income of 30000 they exceed the threshold by 50000 and the 30000 is subject to 1140 of tax. Subject to a 38 unearned income. Updated for Tax Year 2021 August 17 2022 0517 PM.

According to an April 28 2021 Congressional Research Service Report the Joint Committee on Taxation estimates that the net investment income tax will raise approximately. More about the Federal Form 8960 Other TY 2021 We last updated the Net Investment Income Tax - Individual Estates and Trusts in January 2022 so this is the latest version of Form 8960. June 5 2021 340 PM There is a TT oversight regarding form 8960.

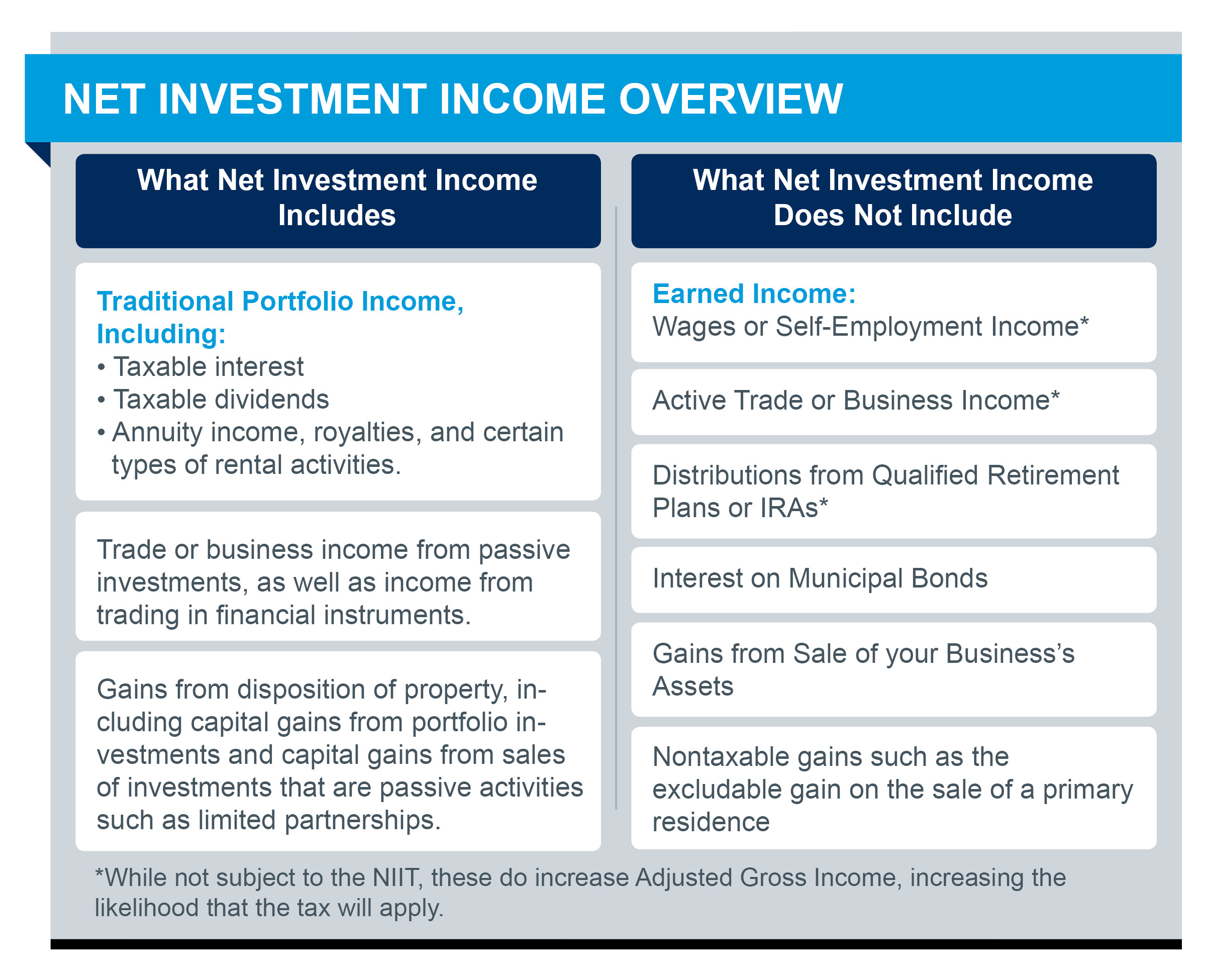

Information about Form 8960 Net Investment Income Tax Individuals Estates and Trusts including recent updates related forms and instructions on how to file. Who is liable for paying the net investment income tax. The net investment income tax is a 38 tax on investment income that typically applies only to high-income taxpayers.

Net Investment Income Tax. TT does not reduce your investment income by state and local taxes when calculating the investment. According to an april 28 2021 congressional research service report the joint committee on.

Generally net investment income includes gross income from interest dividends annuities and royalties. Net investment income tax 2021 form Friday September 9 2022 From within your TaxAct return Online or Desktop click on the Federal tab. The 38 Net Investment Income Tax.

1 2013 individual taxpayers are liable for a 38 percent Net Investment Income Tax on the lesser of their net investment income or the amount by which their modified adjusted. Learn more about Form 8690 and the IRS net investment income tax from the tax experts at HR Block. 1 It applies to individuals families estates and trusts.

20 2019 the excise tax is 2 percent of. Net Investment Income Tax NIIT is a 38 same tax rate tax year 2021 2020 of Medicare tax that applies to investment income and to regular income over a certain threshold. If you earn income from any of your investments this year you may have to pay the net investment.

The estates or trusts portion of net investment income tax is calculated on Form. A recovery or refund of a previously deducted item increases net investment income in the year of the recovery It does not state. Only for clients who purchase and use HR Block desktop software solutions to.

Any taxpayer who has net investment income in any amount and modified adjusted gross income MAGI in excess. It states on page 11.

What Is The Net Investment Income Tax Niit Qsbs Expert

Is An Anomaly In Form 8960 Resulting In An Unintended Tax On Tax Exempt Income

Net Investment Income Tax And How To Avoid It Go Curry Cracker

What Is Form 8960 Net Investment Income Tax Turbotax Tax Tips Videos

Got Questions On Your 1099 Tax Reporting Form We Created A Simple How To Read Tax Form Guide That Covers What You Need To Know In Order To Understand What All Those

2020 Tax Year Forms And Schedules File Your Tax Return

How To Fill Out A W 2 Tax Form For Employees Smartasset

2014 Net Investment Income Tax Probity Advisors Inc

Build Back Better Requires Highest Income People And Corporations To Pay Fairer Amount Of Tax Reduces Tax Gap Center On Budget And Policy Priorities

Net Income What Is It How Is It Measured

Irs Form 1040 Individual Income Tax Return 2022 Nerdwallet

Understanding The Net Investment Income Tax Calculation And Examples Thinkadvisor

How Are Capital Gains Taxed Tax Policy Center

What Is The Net Investment Income Tax And Who Has To Pay It Bankrate

How To Pay No Capital Gains Tax After Selling Your House

Investment Expenses What S Tax Deductible Charles Schwab

How Are Capital Gains Taxed Tax Policy Center

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool